You are invited to attend the Southern Company 2021 Annual Meeting of Stockholders at 10:00 a.m., ET, on Wednesday, May 26, 2021. We will be conducting the annual meeting online for the safety of our stockholders, employees and other attendees. See page 110 for information about how to participate in the virtual annual meeting. By almost any measure, 2020 was a remarkable and challenging year none of us will soon forget. Our nation, our communities and our Company were tested in ways we could not have imagined. Despite the advent of a global pandemic and an exceedingly busy storm season, our business model demonstrated substantial resilience as we delivered outstanding service to customers, provided excellent operational reliability and achieved strong financial performance. Excel at the Fundamentals

Nothing is more fundamental to our business than keeping the lights on and fueling our communities. Our state-regulated electric and gas subsidiaries constantly strive to provide a world-class customer experience. Despite the numerous challenges presented by a global pandemic, we demonstrated our agility and ability to rapidly adapt the way we do business. The record- breaking 2020 hurricane season produced 30 named storms, including 13 hurricanes in a 6-month season. Following these storms, our teams quickly and safely restored electricity and gas service to millions in our system’s service territory and across the eastern half of the U.S. while adhering to COVID-19 safety protocols. Strong Financial Performance Despite the Many Challenges

While revenues were meaningfully lower in 2020 due to the COVID-19 pandemic, we implemented thoughtful cost containment measures across the system to help mitigate the impact of reduced kilowatt hour sales. As a result, we were able to achieve strong adjusted earnings per share and we increased our dividend for the 19th consecutive year. We also effectively executed our capital plan and maintained solid credit ratings across the system. During 2020, Southern continued to deliver positive stockholder returns despite significant market volatility. Continued Progress at Plant Vogtle Construction Project

Construction of the two new nuclear units at Georgia Power’s Plant Vogtle continued to see steady progress in 2020. New health and safety protocols were instituted, which allowed work to continue with enhanced safety precautions. A number of major milestones were accomplished in 2020, including cold hydro testing for Unit 3, the certification of more than 60 plant operators and receipt of the first nuclear fuel shipment for Unit 3. When completed, the two units will feature new state-of-the-art AP1000 reactors. Once operating, these units are expected to provide carbon-free power for more than 500,000 homes and businesses. | Value and Develop Our People

In 2020, we placed great emphasis on the well-being of our workforce, including those in the field and those working from home. We further enhanced our physical, financial and emotional/social health offerings to support our employees’ needs amid the pandemic. We also maintained training, mentoring, leadership and workforce development programs, despite the remote working environment for many. Importantly, we continue to evaluate and modernize our programs to help ensure they attract, engage, include and retain the workforce necessary for today and tomorrow. Events in 2020 also highlighted the racial inequality that persists in America. For years, striving toward equity has been a part of our focus on building a healthy culture. Southern Company is committed to an equitable and inclusive workplace that mirrors the diverse communities we serve, and we are working diligently to prevent inequities in our companies and help ensure a fair and just culture, from the boardroom to the front lines. We have refocused our efforts toward a more holistic goal of diversity, equity and inclusion, helping to ensure all groups are welcomed, well represented, engaged and fairly treated throughout the organization. Setting a Net Zero Target

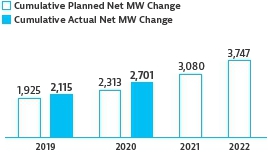

In 2020, we announced an ambitious new goal to achieve net zero greenhouse gas (GHG) emissions by 2050. Southern Company will continue to use a portfolio approach as we seek to decarbonize. We expect our path to net zero to be comprised of several elements including continued coal transition, utilization of natural gas to enable fleet transition, further growth in our portfolio of zero-carbon resources, negative carbon solutions, enhanced energy efficiency initiatives and continued investment in R&D focused on clean energy technologies. Our Values are Key to our Long-Term Success

Safety First confirms that the safety of our employees and customers is paramount, even as we contend with the coronavirus. Unquestionable Trust speaks to our standard of honesty, respect, fairness and integrity in all we do. Superior Performance informs our resolve to sustain operational excellence. Total Commitment demands that we fully embrace, respect and value our differences and diversity as we work for social justice. These values have served us well for many years, and they will continue to guide us through these challenging times. We believe Southern Company is well-positioned to deliver on its value proposition as our customer-and community-focused business model continues to serve us well across the enterprise. We look forward to serving customers with excellence for years to come. “Every decision we make is arrived at by asking one question:How does it benefit the families, businesses, and communities we serve?”

We believe these proposals are thoughtfully structured to serve the best interests of our stockholders and are responsive to current corporate governance trends.

For the first time, we are taking advantage of the notice and access rules of the Securities and Exchange Commission (SEC) that allow us to furnish our proxy materials to you over the internet instead of mailing paper copies to each stockholder. We are mailing a Notice of Internet Availability of Proxy Materials beginning on or about April 8, 2016 to certain of our stockholders. The Notice contains instructions on how to access the proxy materials and vote your proxy. We believe this approach allows us to provide stockholders with a timely and convenient way to receive proxy materials and vote, while lowering the costs of delivery and reducing the environmental impact of the annual meeting.

Your vote is important. We urge you to vote promptly, even if you plan to attend the annual meeting. Thank you for your continued support of Southern Company.

Thomas A. Fanning

Important Notice Regarding the Availability of Proxy Materials for the 2016 Annual Meeting of Stockholders to be held on May 25, 2016:

The proxy statement and the annual report are available atwww.investor.southerncompany.com.

investor.southerncompany.com

Notice of Annual Meeting of Stockholders of Southern Company

Date and Time

Wednesday, May 25, 2016 at 10:00 a.m., ET

Place

The Lodge Conference Center at Callaway Gardens, Highway 18, Pine Mountain, Georgia 31822

Items of Business

• | Elect 15 Directors; | • | Approve a By-Law amendment to permit proxy access; | • | Approve an amendment to the Certificate of Incorporation to reduce the supermajority vote requirements to a majority vote; | • | Approve an amendment to the Certificate of Incorporation to eliminate the “fair price” anti-takeover provision; | • | Approve a By-Law amendment to permit the Board of Directors to make certain future amendments to the By-Laws without stockholder ratification; | • | Conduct an advisory vote to approve executive compensation, often referred to as a say on pay; | • | Approve the material terms for qualified performance-based compensation under the Omnibus Plan in accordance with Section 162(m) of the tax code; | • | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2016; | • | Consider two stockholder proposals, if properly presented at the meeting; and | • | Transact any other business properly coming before the meeting or any adjournments thereof. |

Record Date

Stockholders of record at the close of business on March 28, 2016 are entitled to attend and vote at the meeting. On that date, there were 918,874,386 shares of common stock (Common Stock) of The Southern Company (Southern Company, the Company, we, us, or our) outstanding and entitled to vote.

By Order of the Board of Directors,

Melissa K. Caen, Corporate Secretary

April 8, 2016

| | | | EVERY VOTE IS IMPORTANT TO SOUTHERN COMPANY | |  | | | | | | | | We have created an annual meeting website to make it easy to access our 2016 annual meeting materials. |  | | | | |  | www.southerncompanyannualmeeting.com | | | | | | At the annual meeting website you can find an overview of the items to be voted, our proxy statement and annual report to read online or to download, and a link to vote your shares.

Even if you plan to attend the meeting in person, please vote as soon as possible by using the internet or by telephone or, if you received a paper copy of the proxy form by mail, by signing and returning the proxy form.

We are grateful for your continued support of Southern Company. |  | | At Southern Company, we are bullish on the future. We acknowledge the challenges before us, but we see them as opportunities. Our answer to these challenges must always be “yes, and.” Yes, we acknowledge the challenge, and we are committed to finding a solution. |  |

Thomas A. Fanning

Chairman, President and

Chief Executive Officer

April 12, 2021 |  | |

Table of Contents ii Letter from our Independent Directors | Dear Fellow Stockholders: | | | | As independent Directors, we strive to govern Southern Company in a prudent and transparent manner with a commitment to sound governance principles. We thank you for your confidence in us, as your representatives. Oversight of Long-Term Strategy

One of our Board’s primary responsibilities is overseeing Southern Company’s strategy of maximizing long-term value to stockholders through an employee-, customer-, community- and relationship-focused business model. At each Board meeting and during our regular strategy sessions, we contribute to management’s strategic plan by engaging senior leadership in robust discussions about overall strategy, business priorities and material long-term risks and growth opportunities. In 2020 and continuing today, the COVID-19 pandemic has presented unique challenges, but we are proud of how the Company has responded and the resilience we have seen across the organization. We actively sought to support management as it prioritized the health and safety of our customers, neighbors and employees, while continuing to provide clean, safe, reliable and affordable energy. This past year also made clear that the struggle for racial equality continues. As a Board, we strongly supported the management team as they made clear Southern’s commitment that racism will not be accepted, ignored or dismissed. Throughout the year we continued our focus on the construction of Plant Vogtle Units 3 and 4, which included added complexity presented by the pandemic. We also continued our robust dialogue with management on economically decarbonizing the Southern Company system’s diverse generating fleet and the risks and opportunities for Southern in a low-carbon future. These efforts resulted in the May 2020 update of our long-term GHG emissions reduction goal to net zero emissions by 2050 and the September 2020 publication of the Implementation and Action Toward Net Zero report. In addition, we maintained our focus on core operations, constructive regulatory relationships and employee safety and well-being. By helping management address near-term priorities and obstacles while maintaining a long-term outlook, we are best able to support our common goal of creating enduring long-term value for customers, employees and stockholders alike. Our Board has been and will continue to be committed to the oversight of long-term strategy for the enterprise. | Corporate Governance and Risk Oversight

We remain focused on Board refreshment, Board diversity and meaningful Board succession planning. We have a leading search firm engaged to assist our evergreen search for Board candidates. Since March 2018, we have added four new independent Directors and three directors have retired. In 2020, we welcomed Colette D. Honorable to our team of Directors. Her extensive energy policy and regulation experience are additive to our Board. Effective at the annual meeting, Steven R. Specker and Jon A. Boscia will retire from the Board, and we thank them for their years of dedicated service. The Board aims to further refresh its membership in the coming years, including a continued focus on diverse candidates. During 2020, we undertook a review of the collective qualifications, skills, attributes and experience that we desire on the Board with the aim of ensuring that they are aligned with oversight of long-term strategy and related risks and opportunities. We continued to oversee risk for the enterprise through our six standing committees and as a full Board. Each committee provides ongoing oversight for the most significant risks designated to it, reports to the Board on its oversight activities and elevates review of risk issues to the Board as appropriate. For many key strategic issues, including climate risk, each Board committee considers issues within the scope of its responsibilities, and we have taken steps to promote the Board’s overall oversight as both deep and coordinated. Stockholder Engagement

We maintained our focus on regularly communicating with our stockholders to better understand their viewpoints, gather feedback regarding matters of investor interest and help them understand how we approach our oversight role at Southern. We appreciate that stockholders have a growing list of governance and sustainability topics they wish to discuss and that direct engagement with independent Directors on behalf of the Board is a priority. We remain committed to effective engagement with our investors. In 2020, independent Directors directly engaged (without the CEO present) with stockholders representing about 25% of our outstanding shares. The primary topics discussed included our pandemic response, how the Board oversees our strategy to reduce carbon emissions, executive compensation and human capital management. Thank you for the trust you place in us. We are grateful for the opportunity to serve Southern Company on your behalf. |

|  |  |  |  |  |  | | Dr. Janaki Akella | Vote by Internet or TelephoneJuanita Powell

Baranco | Jon A. Boscia | Henry A. Clark III | Anthony F.

Earley, Jr. | David J. Grain | Colette D.

Honorable |  |  |  |  |  |  |  | | Donald M. James | Voting by the internet or by telephone is fast and convenient, and your vote is immediately confirmed and tabulated.John D. Johns | Dr. Dale E. Klein | Dr. Ernest J. Moniz | William G.

Smith, Jr. | Dr. Steven R.

Specker | E. Jenner Wood III |

Table of Contents 1 Notice of Annual Meeting of Stockholders of Southern Company  | DATE AND TIME

Wednesday, May 26, 2021

10:00 a.m., ET |  | | ACCESS THE ANNUAL MEETING

Stockholders may participate in the virtual annual meeting by logging in at www.virtualshareholdermeeting.com/SO2021 |  |  | |  | RECORD DATE

Stockholders of record at the close of business on March 29, 2021 are entitled to attend and vote at the annual meeting. On that date, there were 1,059,661,292 shares of common stock of Southern Company outstanding and entitled to vote. | | On April 12, 2021, these proxy materials and our annual report are being mailed or made available to stockholders. |

Items of Business

Stockholders are being asked to vote on the agenda items described below and to consider any other business properly brought before the 2021 annual meeting and any adjournment or postponement of the meeting. | 1 | www.proxyvote.com

24/7 | | 1-800-690-6903

24/7 | Elect 13 Directors | | 2 | | Conduct an advisory vote to approve executive compensation | | 3 | Approve the 2021 Equity and Incentive Compensation Plan | | 4 | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2021 | | 5 | Approve an Amendment to the Restated Certificate of Incorporation to Reduce the Supermajority Vote Requirement to a Majority Vote |

Every Vote is Important to Southern Company

We have created an annual meeting website at southerncompanyannualmeeting.com to make it easy to access our 2021 annual meeting materials. At the annual meeting website you can find an overview of the items to be voted, the proxy statement and the annual report to read online or to download, as well as a link to vote your shares. Even if you plan to participate in the virtual annual meeting, please vote as soon as possible by internet or by telephone or, if you received a paper copy of the proxy form by mail, by signing and returning the proxy form.  | Vote by Mail

| | | | | |  | | | | | | If you received a paper copy of the proxy form by mail, you can mark, sign, date and return the proxy form in the enclosed, postage-paid envelope. |

| | Vote by Internet or Telephone | Voting by internet or by telephone is fast and convenient, and your vote is immediately confirmed and tabulated. Internet www.proxyvote.com (24/7) Telephone 1-800-690-6903 (24/7) |

By Order of the Board of Directors.

April 12, 2021 Important Notice Regarding the Availability of Proxy Materials for the 2021 Annual Meeting of Stockholders to be held on May 26, 2021: The proxy statement and the annual report are available at investor.southerncompany.com. In light of the ongoing COVID-19 pandemic, for the safety of our stockholders, employees and other attendees, and taking into account recent federal, state and local guidance that has been issued, we have determined that the 2021 annual meeting will be held in a virtual meeting format only via the internet. There will be no physical location for stockholders to attend. Stockholders will be able to participate in the virtual annual meeting, vote and submit questions from any location via the internet by logging in at www.virtualshareholdermeeting.com/SO2021, and by entering the 16-digit control number on your proxy card, voting instruction form or Notice of Internet Availability you previously received. Stockholders who do not receive a 16-digit control number should consult their voting instruction form or Notice of Internet Availability and may need to obtain a legal proxy in advance of the virtual annual meeting in order to participate. A list of our stockholders of record will be made available to stockholders during the virtual annual meeting at the same link. Please see page 110 for more information. |

Table of Contents 2 Our Company We are one of America’s premier energy companies, with 42,000 megawatts of electric generating capacity and 1,500 billion cubic feet of combined natural gas consumption and throughput volume serving 9 million customers through our subsidiaries, a competitive generation company serving wholesale customers across America and a nationally recognized provider of customized energy solutions, as well as fiber optics and wireless communications. 42,000 MW

of generating capacity Capabilities in

50 States 9 Million

customers Approximately

28,000

employees 7

electric & natural gas utilities | | Major Subsidiaries | |

1.5 million electric utility customers |

2.6 million electric utility customers

|

188,000 electric utility customers

| |

11,920 MW of wholesale solar, wind, natural gas and clean alternative technology provider in 13 states

|

A national leader in distributed infrastructure technologies doing business nationwide

|

An innovative leader among the nation’s nuclear energy industry

| |

Wireless communications service

|  4.3 million natural gas distribution customers across four state-regulated, wholesale and retail energy businesses and gas storage facilities in the U.S. 4.3 million natural gas distribution customers across four state-regulated, wholesale and retail energy businesses and gas storage facilities in the U.S.►Atlanta Gas Light (GA) ►Chattanooga Gas (TN) ►Nicor Gas (IL) ►Virginia Natural Gas (VA) | | See the inside back cover of this proxy statement for a map of our service territories. | | |

Our Strategy We are one of America’s premier energy companies, delivering clean, safe, reliable and affordable energy to our electric and natural gas customers through our state regulated utilities. Our strategy is to maximize long-term value to stockholders through a customer-, community- and relationship-focused business model that is designed to produce sustainable levels of return on energy infrastructure. | Our Decarbonization Efforts | | | | | |

Southern Company is committed to providing clean, safe, reliable and affordable energy, with a focus on reducing GHG emissions. Since 2007, the percentage of energy generated from coal across our system has decreased approximately 75% and the percentage of energy generated from carbon-free sources has increased 113%. | Annual Energy Mix* | | * | Annual energy mix represents all of the energy the Southern Company system uses to serve its retail and wholesale customers during the year. It is not meant to represent delivered energy mix to any particular retail customer or class of customers. Annual energy mix percentages include non-affiliate power purchase agreements. Renewables/Other category includes wind, solar, hydro, biomass and landfill gas. With respect to certain renewable generation and associated renewable energy credits (RECs), to the extent an affiliate of Southern has the right to the RECs associated with renewable energy it generates or purchases, it retains the right to sell the energy and RECs, either bundled or separately, to retail customers and third parties. |  | | |

Table of Contents 3 Our 2020 Performance Outstanding Response and Resiliency During Unprecedented Times

Despite extraordinary circumstances in 2020 due to the COVID-19 pandemic and an exceedingly busy storm season, our business model demonstrated substantial resilience, delivering outstanding service to customers, providing excellent operational reliability and achieving strong financial performance. We were well-prepared to quickly adjust and executed COVID-19 pandemic plans across all businesses, maintaining the Southern Company system’s critical operations while also emphasizing employee, customer and community safety. | ► | A top priority was to keep our employees healthy and safe, all while continuing to provide clean, safe, reliable and affordable energy for our customers. One of our best assets is the reliability and resiliency of our workforce. | | ► | We rapidly procured and deployed necessary protective equipment and implemented effective safety protocols. | | ► | Our operations and customer service teams continued to provide essential services to customers. | | ► | We found solutions for many of our teams to work remotely, and we devised new communication strategies that allowed us to connect with our workforce and external stakeholders in a whole new way. | | ► | We did not reduce our employee workforce or reduce pay for our employees, nor did we adjust the metrics and goals in our annual and long-term incentive compensation plans in response to the COVID-19 pandemic. |

Delivered Strong Financial Results and Created Value for Stockholders

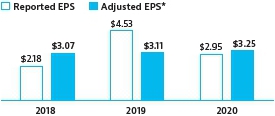

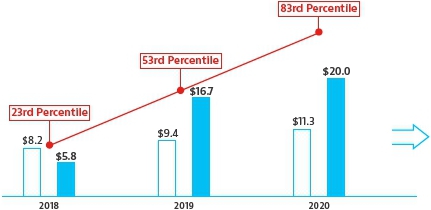

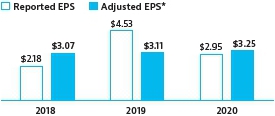

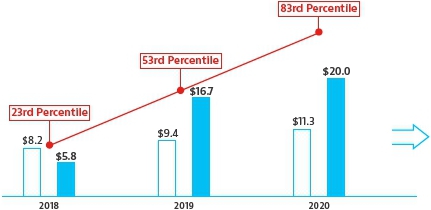

2016 Proxy StatementOur goal is to deliver long-term value to stockholders with appropriate risk-adjusted TSR. During 2020, we made thoughtful, effective adjustments to our business that allowed us to weather the COVID-19 pandemic. By continuing to prioritize the well-being of our employees, customers and communities, we maintained our strong track record of reliability, Georgia Power made meaningful progress at Plant Vogtle Units 3 and 4 and we successfully executed our financial plan. | ► | We reported strong EPS performance, with adjusted EPS above the top end of our guidance range for 2020. While revenues were meaningfully lower in 2020 due to the COVID-19 pandemic, we implemented thoughtful cost containment measures across the system to help mitigate the impact of reduced kilowatt hour sales. | | ► | We increased our dividend for the 19th consecutive year, with dividend yield as of year-end 2020 at 4.1%. | | ► | We effectively executed our capital plan, maintained solid credit ratings across the system and continue to foresee no need for equity issuances in the capital markets through 2025. |

|  | Reduced GHG Emissions and Committed to Net Zero by 2050 | | |

Our strategy includes the continued development of a diverse portfolio of energy resources to serve customers and communities reliably and affordably with a focus on reducing GHG emissions. Back► | In 2018, we were one of the first U.S. utilities to Contentset bold, industry-leading goals to reduce GHG emissions. In 2020, we updated our long-term decarbonization goal to net zero by 2050 and indicated that we expect to sustainably achieve our 2030 goal of 50% GHG emissions reduction well in advance of 2030 and possibly as early as 2025. | | ► | In 2020, we reported that our GHG emissions decreased by 52% since 2007, compared to the decrease we reported in 2019 of 44% since 2007. Our generation from coal dropped to 17% in 2020, compared to 22% in 2019 and 69% in 2007. The reduction in GHG emissions from 2019 to 2020 was primarily driven by milder weather, decreased customer energy usage resulting from the COVID-19 pandemic and the continued transition to lower-emitting and zero carbon resources. | | ► | The work of planning, transitioning and operating our system to meet our decarbonization goals will require continued active and constructive engagement with government officials, investors and a wide variety of other public and private stakeholders. Our success will require the support of policies that encourage and advance innovation while protecting the affordability, reliability and resilience of the service we provide to our customers. |

Table of Contents Southern Company 2021 Proxy Statement

4 | Earnings per Share ($) | | Dividends Paid per Share ($) |  | |  | Increased

8 cents

in 2020 Paid

$2.7B

to stockholders in 2020 |

| * | For a reconciliation of adjusted EPS to EPS under GAAP, see page 115. |

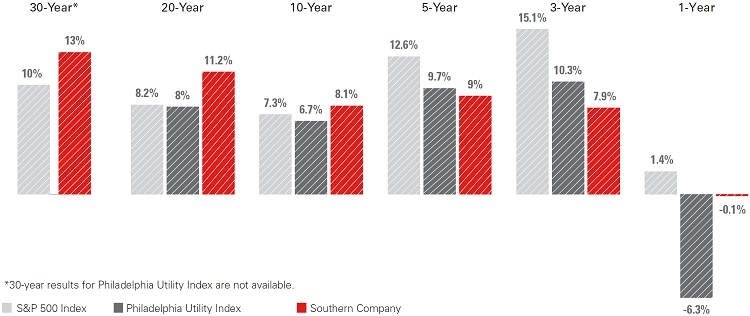

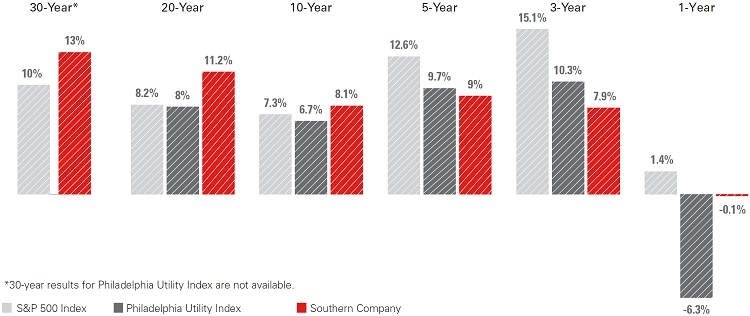

Our TSR significantly outperformed the Philadelphia Utility Index and the Dow Jones Industrial Average for the three-year period ended December 31, 2020. This is primarily due to the 51.6% TSR result for 2019. During 2020, we continued to deliver positive stockholder returns despite significant market volatility. We have reliably demonstrated strong TSR performance over the long-term 25 year period. Total Shareholder Return (Annualized) | | 1-Year | | 3-Year | | 5-Year | | 25-Year | | Southern Company | | 0.66 % | | 13.64 % | | 10.57 % | | 11.03 % | | Philadelphia Utility Index | | 2.72 % | | 10.45 % | | 12.29 % | | 8.82 % | | S&P 500 Index | | 18.39 % | | 14.13 % | | 15.19 % | | 9.54 % | | Dow Jones Industrial Average | | 9.72 % | | 9.87 % | | 14.62 % | | 9.91 % |

| * | Source: Bloomberg using quarterly compounding as of December 31, 2020. |

Continued Progress at Georgia Power’s Plant Vogtle Units 3 and 4 Construction Project

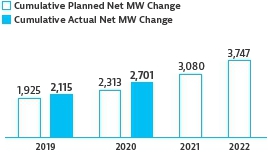

At Plant Vogtle Units 3 and 4, major milestones were completed despite significant impacts from the pandemic on our workforce and site construction productivity. | ► | Strong leadership at the site allowed us to move quickly to establish effective COVID-19 protocols. We engaged independent medical advisors to guide our actions and reduce the possible spread of the virus and consulted closely with the U.S. Nuclear Regulatory Commission, the project’s co-owners and local and state authorities. The president of North America’s Building Trades Unions commended us for going above and beyond the call of duty to help keep their members on the project site safe and healthy. | | ► | Though productivity at the site slowed because of the pandemic and the total estimated cost to complete rose by $325 million, major milestones were achieved during 2020 including cold hydro testing at Unit 3 and control room ready for testing at Unit 4. |

Proxy Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Meeting Agenda

Stockholders are being asked to vote on ten agenda itemsExcelled at the 2016 annual meeting.

Fundamentals

Our operating subsidiaries continued to rank in the top quartile on the Customer Value Benchmark Survey and were recognized among the most highly rated utilities for customer satisfaction and for best practices in COVID-19 Customer Communication by J.D. Power. | ► | | Item 1 | | Despite the pandemic, we maintained outstanding operational performance throughout the year, with rapid service restoration following major storms and tornadoes in the Southeast and exceptional reliability in natural gas delivery. Georgia Power received a StormReady Supporter certification from the National Weather Service, indicating its commitment to the community to be prepared for severe weather events. | | ► | | | | We continued to enhance our cyber and physical security programs and operational resiliency through targeted technological deployments and all-hazards planning and testing. | | ► | In addition to our focus on health and safety during the pandemic, we continued our long-term commitment to employee safety by concentrating efforts on safety processes, safety culture and risk reduction to prevent injuries. |

Table of Contents Our 2020 Performance

5 Our Environmental and Social

Highlights | | | | | | Our GHG Reduction Goals In 2018, we set an interim goal to reduce system-wide GHG emissions by 50% by 2030 (from 2007 levels) and a long-term goal of low- to no- carbon emissions by 2050. Since 2018, the discourse around decarbonization efforts in the U.S. and beyond, including with our Board and stakeholders, has evolved to incorporate concepts related to negative carbon technologies. In 2020, as a result of this evolution and our evaluation of opportunities to incorporate net zero concepts into our long-term strategy, we updated our long-term GHG emissions reduction goal to net zero emissions by 2050. We believe our path to net zero by 2050 will be achieved through: ►Continued coal transition ►Utilization of natural gas to enable fleet transition ►Further growth in portfolio of zero-carbon resources ►Negative carbon solutions ►Enhanced energy efficiency initiatives ►Continued investment in R&D focused on clean energy technologies In 2020, we achieved a 52% reduction in GHG emissions driven by a combination of reduced demand due to the pandemic, mild weather and the continued deployment of zero-carbon resources. We expect to reach a sustainable reduction of 50% by 2025, or possibly earlier. Protecting our Workforce Throughout 2020 In 2020, we faced a global health pandemic, an economic downturn and social and political unrest that impacted our communities and our nation. These events placed mental, physical and financial burdens on many of our employees. Throughout the year and into 2021, we faced each issue head-on and established a robust communication pipeline that kept employees informed and updated about issues facing the Company and the community. ►In response to the pandemic, we developed a pandemic playbook for Southern Company that was ultimately leveraged and deployed by several peer utilities. Key elements included extensive CDC-compliant safety programs at our operational sites, coverage of all COVID-19 testing through our benefit plans and new well-being toolkits with resources addressing stress management, exercising, healthy eating and working from home. | ELECT 15 DIRECTORS |  | | | Board Oversight of ESG

Our Board is engaged in overseeing our business strategies and related risks and opportunities, which includes ESG topics. Our Committee structure facilitates oversight of issues that impact many areas of our business. Committees report out to the full Board on key issues. Examples of ESG oversight include: ►The Operations, Environment and Safety Committee has primary oversight of strategies to reduce carbon emissions, fleet transition system reliability and safety. ►The Finance Committee has primary oversight over capital investment, including alignment with our climate objectives. ►The Compensation and Management Succession Committee has primary oversight over human capital management, including our diversity, equity and inclusion initiatives. ►The Nominating, Governance and Corporate Responsibility Committee has primary oversight over the Company’s practices and positions to advance its corporate citizenship, including environmental, sustainability and corporate social responsibility initiatives. |

Table of Contents Southern Company 2021 Proxy Statement

6 $1.5 billion

in diverse spend

We spend approximately $1.5 billion annually with diverse suppliers, representing approximately 25% of sourceable procurement spend.

200,000

volunteer hours

In an average year, our retirees and employees dedicate approximately 200,000 hours of volunteer service to improve the communities we serve.

$65 million

in total giving

We make direct corporate contributions and endow and fund independent, nonprofit company foundations that contribute to arts and culture, health and human services, civic and community projects, safety, education and the environment. Total giving across the system typically exceeds $65 million annually.  | | | ►We have utilized new 401(k) and healthcare legislation to help ensure employee financial stability during the pandemic. We leveraged our existing innovative and comprehensive benefit programs and technologies for quick and easy remote access to physical, mental and financial help. ►Throughout the year, we continued regular communication with employees throughout the organization, including town hall meetings led by our CEO and the CEOs of our operating subsidiaries and regular emails providing updates with reminders of key benefits and descriptions of new well-being toolkits. ►Racism has no place in our Company nor in our communities. We acknowledge that we must do our part, and that starts with our employees, customers and partners. During 2020, we moved quickly to enhance our efforts to address racial equity as described below, and we recognize that this work must continue in 2021 and beyond. ►In addressing the 2020 elections and events that followed, including in early 2021, we communicated with our employees and stakeholders that our belief in government, respect for the democratic process and adherence to the rule of law always have been part of our core principles. We are constantly evaluating our engagement efforts with policy makers to ensure they are informed by these ideals and adhere to the uncompromising values we follow as a business – honesty, respect, fairness, integrity and the value of diversity. We are a Citizen Wherever We Serve We are committed to supporting and improving our communities while conducting business with honesty, integrity and fairness. In 2020, our commitments to safety, outreach and engagement allowed us to quickly respond to needs in our communities arising from the pandemic. ►Our operating companies worked closely with customers offering special payment plans for those with past-due account balances and delaying disconnects. ►We implemented health protocols that helped our field employees protect themselves, our customers and communities while continuing to provide essential electric and gas services and maintain reliability. ►We are working with relief organizations in several states to help lessen the health, community and economic impacts of COVID-19. Southern Company and its subsidiaries are targeting a COVID-19 relief commitment of nearly $10 million in foundation and other charitable contributions in the areas of food insecurity, homelessness and displaced workers. In addition to financial support, our employees have logged thousands of volunteer hours to assist those impacted by the pandemic. Our Commitment to Racial Equity In 2020, we strengthened our holistic approach to diversity, equity and inclusion and focused on building a healthy and diverse culture, as described in Our Human Capital Beliefs on page 8. We are also proud of our ongoing commitment to foster racial justice. We are committed to be a role model among companies forging change. Following events last year highlighting racial injustice in our society, we have developed a framework, posted on our website, which confirms our collective commitment to racial equity. Key efforts include: ►Talent: Committing to a diverse, equitable and inclusive workplace to better serve our customers and communities; increase and improve outreach, recruitment, hiring and retention of diverse groups at all levels of the workforce; help ensure equity in leadership development programs; and seek diverse candidate slates for all positions, including management roles ►Culture: Committing to promote an actively anti-racist culture and to help ensure that all groups, and especially historically underrepresented and marginalized groups, are well-represented, included and fairly treated within all levels of the organization and that everyone feels welcomed, valued and respected |

Table of Contents Our 2020 Performance

7 ►Community: Committing $200 million over five years to advance racial equity and social justice in our communities with a focus on criminal justice reform, economic empowerment and the advancement of educational equality. This includes a planned donation of $50 million to historically black colleges and universities (HBCUs) in our service territories. As part of this commitment, the Southern Company Foundation announced a partnership with Apple with each company investing $25 million to launch the Propel Center, a new digital learning hub, business incubator, and global innovation headquarters located in Atlanta for students of HBCUs throughout the nation. ►Political Engagement: Advocating for racial equity through our political engagement, policy positions and ongoing public dialogues ►Suppliers: Aiming to increase our minority business enterprise spend to 20% and total diverse spend to 30% by 2025 and committing to developing and doing business with more Black-owned businesses in our industry and communities Our Commitment to Transparency We recognize the value our investors and stakeholders place on transparency, and we are committed to continued enhancements. In September 2020, we published an updated climate report, Implementation and Action Toward Net Zero, which included disclosure responsive to recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), and we added a number of disclosures to our website over the last year in response to investor feedback. These new additions include disclosure aligned to TCFD, the standards of the Sustainability Accounting Standards Board (SASB) and the Edison Electric Institute (EEI) ESG/ Sustainability Reporting Template. We actively review reports and ratings issued by ESG data providers and identify disclosures that can inform their analyses. As a result of these efforts, we have seen an increase in our ratings over the past few years. ►Our MSCI ESG rating has improved from BBB to AA. ►We earned a score of A- from the CDP Climate Change Disclosure for our environmental transparency and leadership within the North America region and thermal power generation sector. This represents a significant improvement since we restarted reporting to CDP in 2018. We continue to engage with our investors and stakeholders to focus on providing meaningful disclosures. Our Sustainable Financing Framework In January 2021 we became the first large cap utility in the U.S. to publish a Sustainable Financing Framework, and in the first quarter our subsidiaries issued both Green and Sustainable bonds totaling $1.15 billion in principal amount. This framework highlights Southern’s ongoing commitment to a wide range of sustainability and social issues and should allow us to leverage our work in these areas to help optimize our balance sheet and benefit customers. ►In January 2021, Southern Power issued a $400 million green bond with net proceeds to be allocated to fund development of its robust renewables energy portfolio. ►In February 2021, Georgia Power issued the first sustainability bond for a domestic utility in the United States. With net proceeds of approximately $743 million to be allocated to fund sustainable projects such as our spending with diverse and small business suppliers and our investments in renewable energy projects, the bond aligns with our ongoing commitments to the community and the continued growth of Georgia Power’s solar portfolio, one of the largest voluntary renewable portfolios in the country. | | |

$3.9 billion

in green bonds

The Southern Company system has issued a combined total of nearly $3.9 billion in green bonds, which ranks within the top five among all U.S. corporate green bond issuers |

Table of Contents Southern Company 2021 Proxy Statement 8 Our Human Capital Beliefs Southern Company’s foundation is built on being a citizen wherever we serve. We are fully engaged with and committed to the success of employees, customers, stockholders and communities. Our Values foster a diverse, inclusive, equitable and innovative culture so that employees can execute our business strategy with agility and accountability. | ► | We believe in and invest in the well-being of our employees through a total rewards strategy that includes competitive salary, annual incentive awards for almost all employees* and health, welfare and retirement benefits designed to encourage physical, financial and emotional/social well-being. | | ► | Development and retention of our talent is a priority. The addition of external hires augments our existing workforce as we seek to meet changing business needs, address any critical skill gaps and supplement and diversify our talent pipelines. | | ► | We are proud of our positive relationships with labor unions and support the rights to collective bargaining and freedom of association. | | ► | We support human rights and are opposed to all forms of forced labor, child labor and other human rights abuses. | | ► | Our employees, suppliers and partners are expected to act in a manner consistent with Our Values, Our Human Capital Beliefs, Our Code of Ethics and U.S. and international law. | | * | Certain employees are not eligible for our incentive program due to collective bargaining agreements. |

| Our Human Capital Pillars |

| Diversity, Equity & Inclusion |

| ► | We are committed to a diverse, equitable and inclusive workplace to better serve our customers and communities. | | ► | Our strategy for recruiting, hiring, retaining and developing employees includes a deliberate focus on diversity, equity and inclusion. | | ► | We integrate continuous feedback from employees to refine our commitments and actions. |

Diversity makes us stronger and provides a competitive advantage | ► | Adopted new commitments to attract, engage, include and retain a diverse workforce | | ► | Management team includes 24% women and 22% people of color | | ► | Committed to enhanced transparency and will begin disclosing aggregated EEO-1 workforce diversity data in 2021 |

| Rewards & Well-Being |

| ► | We define total well-being in three categories: physical, financial and emotional well-being. | | ► | We provide meaningful and valuable benefits that support all employees. | | ► | We continue to evaluate and modernize our programs to help ensure they attract, engage, include and retain the workforce necessary for today and tomorrow. |

Total Rewards strategy provides physical, financial and emotional well-being | ► | Highly skilled and technical jobs are compensated for outstanding performance | | ► | Conducted comprehensive pay equity analysis throughout the enterprise using third-party experts | | ► | Improved employees’ 401(k) utilization and understanding (e.g. increased participation to 94%, increased average saving rate close to 10%) | | ► | 82% of workforce participate in physical well-being programs | | ► | Significant investments in emotional well-being programs |

Table of Contents Our 2020 Performance 9  | Talent Development |

| ► | We focus development on Business Imperatives: Inclusivity, Emotional Intelligence, Courage and Business Execution. | | ► | Through a robust succession planning process and strategic external hiring, we help ensure a well-qualified and diverse pipeline of leaders. | | ► | Our custom internal programs, external partnerships and online resources provide career and leadership development opportunities for employees at all levels – from individual contributors to senior leaders. | | ► | Across Southern, our performance management process, Connected Conversations, provides a platform for frequent and meaningful performance and development conversations between managers and employees, driving individual performance and growth. |

Talent Development is key to leadership readiness, employee engagement and retention | ► | Leadership roles are primarily filled from succession planning slates, often providing opportunity for intercompany transfers | | ► | Highly engaged workforce as measured by Voice of the Employee Survey | | ► | Low turnover rates and high promotion rates into first-time supervisor roles |

| Workforce Sustainability |

| ► | We focus on having the right people with the right skills who are trained to perform their jobs safely to meet current and future business requirements. | | ► | Safety First: We believe the safety of our employees and customers is paramount. We strive to perform and maintain every job, every day, safely. | | ► | Strong relationships with labor unions improves the lives of our employees and communities. | | ► | We focus on training to help ensure that each employee has a specific developmental program for personal growth and career development. |

Sustainable jobs within our communities | ► | Over 30% of employees were covered by agreements with labor unions | | ► | Over 40 hours of training per year for most employees |

| Community |

| ► | Partnerships with businesses, academic institutions, local governments and other organizations bring new business to our service footprint. | | ► | Our charitable support is designed to focus on the issues critical to the success of the Company, customers and our stockholders; the Company’s commitment to diversity, equity and inclusion extends to the way we support our communities. | | ► | We foster collaborative partnerships with schools to invest in the next generation with STEM-focused programs. |

A community-focused business model is important to our long-term success | ► | We are engaged citizens in the local community | | ► | We are bigger than the bottom line | | ► | Committed over $200 million to advance racial equity and social justice in our communities over the next five years |

Table of Contents Southern Company 2021 Proxy Statement 10 Significant Recognition for our Accomplishments From innovating our industry to making strides in sustainable energy, human capital management and corporate culture, we are recognized as a leader by customers, partners, investors and employees as well as the broader business, science and technology communities. |  | | | |  | | | | | •Human Capital and Corporate Culture | |

Among the Top 50 Companies for Diversity by DiversityInc. (5th consecutive year) Ranked No. 2 in G.I. Jobs magazine 2020 Top 100 Military-Friendly Employers | ► | Top-ranked utility for 14th consecutive year, and 3rd consecutive year in the Gold Top 10 |

2020 Best Places to Work for Disability Inclusion by The Disability Equality Index (perfect score for the 4th consecutive year) Southern Company recognized in the Wall Street Journal Management Top 250 Listed on the 2020 Best Diversity Practices Index A 2020 Best Place to Work for LGBTQ Equality by Human Rights Campaign’s Corporate Equality Index (4th consecutive year) 2020 Best Places to Work in IT by IDG’s Computerworld 2020 Top 50 Employer by Minority Engineer magazine Mississippi Power won two of the Southeastern Electric Exchange’s five industry safety awards in 2020 Three executives recognized in 2020 Atlanta’s Top 100 Black Women of Influence by the Atlanta Business League  | | | Customer Satisfaction |

Georgia Power ranked No. 2 by J.D. Power for 2020 Business Customer Satisfaction among Large Utilities in the South Chattanooga Gas, Nicor Gas and Virginia Natural Gas named as 2020 Most Trusted Business Partners in the utility industry by The Cogent Syndicated Utility Trusted Brand & Customer Engagement™: Business study from Escalent  | | | Governance & Leadership |

2020 World’s Most Admired Companies by FORTUNE magazine for the 9th consecutive year 2020 Most Transparent Utility, No. 6 overall for corporate disclosure and No. 2 for Best Investor Relations Website in Labrador’s 2020 Transparency Awards

Alabama Power recognized as 2020 Company of the Decade by the Birmingham Business Journal  | | | Sustainability & Community Partnerships |

Partners for Environmental Progress (PEP) awarded the Environmental Stewardship Award in 2020 to the Alabama Power Plant Barry Environmental Stewardship Team Plant Scherer was awarded the 2020 Waste to Energy Award by the Georgia Chapter of the Solid Waste Association of North America The National Association of Secretaries of State recognized Alabama Power with the Medallion Award in 2020 for efforts following Hurricane Zeta to ensure polling locations had power for a smooth and successful election Edison Electric Institute (EEI) awarded the Emergency Assistance Award and Emergency Recovery Award to Alabama Power for power restoration efforts after Hurricane Laura and Hurricane Sally in 2020  | | | Innovation & Technology |

Virginia Natural Gas won the 2020 Excellence in Outreach Innovation Award for its enhanced communication platform, Keep Me Informed -Department of Mines, Minerals and Energy Awards (DMME) and Virginia Oil and Gas Association (VOGA) Alabama Power was awarded the 2020 Smart Grid Award by POWER magazine for their Smart Neighborhood at Reynolds Landing Georgia Tech Microgrid was recognized by Public Utilities Fortnightly magazine in their 2020 Smartest Utility Projects

Table of Contents 11 | | | ITEM 1 | Election of 13 Directors | | ✓

The Board

recommends a vote

FOR each nominee

for Director See page 17 ► | | ► | The Board, acting upon the recommendation of the Nominating, Governance and Corporate Responsibility Committee, has nominated 13 of the Directors currently serving for re-election to the Southern Company Board of Directors. | | | — | Janaki Akella | — | David J. Grain | — | Dale E. Klein | | | — | Juanita Powell Baranco | — | Colette D. Honorable | — | Ernest J. Moniz | | | — | Henry A. Clark Ill | — | Donald M. James | — | William G. Smith, Jr. | | | — | Anthony F. Earley, Jr. | — | John D. Johns | — | E. Jenner Wood Ill | | | — | Thomas A. Fanning | | | | | | | ► | Each nominee holds or has held senior executive positions, maintains the highest degree of integrity and ethical standards and complements the needs of the Company.Company and the Board. | | | | | | | •► | Through their positions, responsibilities, skills and perspectives, which span various industries and organizations, these nominees represent a Board of Directors (Board) that is diverse and possesses appropriate collective qualifications, skills, knowledge and experience in accounting, finance, leadership, business operations, risk management, corporate governance, and our industry and subsidiaries’ service territories.experience. | | ITEM 2 | Advisory Vote to Approve Executive Compensation (Say on Pay) | | | |  | ✓

The Board

recommends a vote

FOReach Director nominee. | this proposal See page 93 ► | | ► | We believe our compensation program provides the appropriate mix of fixed and at-risk compensation. | | | ► | The short- and long-term performance-based compensation program for our CEO ties pay to Company performance, rewards achievement of financial and operational goals, relative TSR and progress on meeting our GHG reduction goals, encourages individual performance that is in line with our long-term strategy, is aligned with stockholder interests and remains competitive with our industry peers. | | ITEM 3 | Approve the 2021 Equity and Incentive Compensation Plan (2021 Omnibus Plan) | | ✓

The Board

recommends a vote

FOR this proposal See page 94 ► | | ► |  | Seepage 12 for further information. | | | ► | The Board approved the 2021 Omnibus Plan, subject to approval by stockholders at the annual meeting. If approved, the 2021 Omnibus Plan will succeed the 2011 Omnibus Plan. | |

Table of Contents Southern Company 2021 Proxy Statement 12 ITEM 4 | Ratify the Independent Registered Public Accounting Firm for 2021 | | |

Director Nominees

| Juanita Powell✓

The Board

recommends a vote

BarancoFOR

Executive Vicethis proposal

President and Chief

Operating Officer of

Baranco Automotive

Group

| |  | Jon A. Boscia

Founder and

President,

Boardroom Advisors

LLC | |  | Henry A. “Hal”

Clark III

Senior Advisor of

Evercore Partners

Inc.See page 105 ► | | ► | The Audit Committee appointed Deloitte & Touche as our independent registered public accounting firm for 2021. | | | | Age:67► | This appointment is being submitted to stockholders for ratification. | Age:63 | | Age:66 | Director since:2006ITEM 5 | | Director since:2007 | | Director since:2009 | Independent Director:Yes | | Independent Director:Yes | | Independent Director:Yes | Current Committees:Audit | | Current Committees:Audit (Chair) | | Current Committees:Compensation and Management Succession (Chair), Finance |

investor.southerncompany.com

| Thomas A. Fanning

Chairman of the

Board, President,

and Chief Executive

Officer (CEO),

Southern Company | |  | David J. Grain

Founder and

Managing Partner of

Grain Management

LLC | |  | Veronica M. Hagen

CEO, Polymer Group,

Inc. (retired) | | | | | | Age:59 | | Age:53 | | Age:70 | Director since:2010 | | Director since:2012 | | Director since:2008 | Independent Director:No | | Independent Director:Yes | | Independent Director:Yes, Lead | Current Committees:None | | Current Committees:Compensation and Management Succession, Finance | | Independent Director through May 2016

Current Committees:Compensation and Management Succession, Nuclear/Operations

| | | | | | | | |  | Warren A. Hood, Jr.

Chairman and CEO,

Hood Companies Inc. | |  | Linda P. Hudson

Founder, Chairman,

and CEO, The Cardea

Group | |  | Donald M. James

Chairman and

CEO, Vulcan

Materials Company

(retired) | | | | | | Age:64 | | Age:65 | | Age:67 | Director since:2007 | | Director since:2014 | | Director since:1999 | Independent Director:Yes | | Independent Director:Yes | | Independent Director:Yes | Current Committees:Audit | | Current Committees:Governance,

Nuclear/Operations, Business

Security Subcommittee | | Current Committees:Finance,

Governance (Chair) | | | | | | | | |  | John D. Johns

Chairman and CEO,

Protective Life

Corporation | |  | Dale E. Klein

Associate Vice

Chancellor of

Research, University of

Texas System | |  | William G. Smith, Jr.

Chairman, President,

and CEO, Capital City

Bank Group, Inc. | | | | | | Age:64 | | Age:68 | | Age:62 | Director since:2015 | | Director since:2010 | | Director since:2006 | Independent Director:Yes | | Independent Director:Yes | | Independent Director:Yes | Current Committees:Audit | | Current Committees:Governance,

Nuclear/Operations, Business

Security Subcommittee (Chair) | | Current Committees:Finance (Chair),

Compensation and Management

Succession | | | | | | | | |  | Steven R. Specker

President and CEO,

Electric Power

Research Institute

(retired) | |  | Larry D. Thompson

John A. Sibley

Professor of Corporate

and Business Law,

The University of

Georgia School of

Law | |  | E. Jenner Wood III

Corporate Executive

Vice President –

Wholesale Banking,

SunTrust Banks, Inc. | | | | | | Age:70 | | Age:70 | | Age:64 | Director since:2010 | | Director since:2014 | | Director since:2012 | Independent Director:Yes

Current Committees:Nuclear/

Operations (Chair), Compensation and

Management Succession | | Independent Director:Yes, Lead

Independent Director commencing

May 2016

Current Committees:Finance,

Governance | | Independent Director:YesCurrent Committees:Governance,

Nuclear/Operations

|

Southern Company2016 Proxy Statement

| | | | | Key Corporate Governance Practices | | | | | | | | | | We seek to establish corporate governance standards and practices that create long-term value to our stockholders and positive influences on the governance of the Company. Our key corporate governance practices include: | | |

| | | • | Annual election of Directors | | | | | • | Majority voting for Directors, with

a director resignation policy | | | | | • | 10% threshold for stockholders to request a special meeting | | | | | • | 14 of 15 Directors are independent | | | | | • | All Board committees are comprised of independent Directors | | | | | • | Strong Lead Independent Director | | | | | • | Annual Board and committee self-evaluations | | | | | • | Proactive stockholder engagement | | | | | • | Diverse Board | | | | | • | Clawback policy under our Omnibus Plan | | | | | • | Strong stock ownership guidelines | | | | | | | |

| | | | | Recent and Proposed Governance and Disclosure Enhancements | | | | | | | |

| | | • | Proposed a proxy access right for stockholders…seepage 34 | | | | | • | Proposed amendmentsApprove an Amendment to the Restated Certificate of Incorporation to further enhance stockholder rights…seepages 36 and 37 | | | Reduce the Supermajority Vote Requirement to a Majority Vote | | | • | Continued our stockholder engagement efforts …seepage 26✓ | | | | | • | Adopted a no pledging policy …seepage 44 | | | | | • | Identified a second audit committee financial expert …seepage 28 | | | | | • | Added seven new directors to the Board in the past five years ...seepage 24 | | | | | • | Added disclosure about Board refreshment, Board and committee self-evaluations, and management succession planning ...seepages 24 and 25 | | | | | | | |

| | | | | | | | | | | | Board Tenure

Tenure of Independent Directors (Years of consecutive service)

Average Tenure of Independent Directors:6.4 years

Board Independence

All Director Nominees are Independentexcept the CEO

Board Diversity

| | | | | | | | | | | | |

| | | | | | | | | | | | Qualifications, Attributes, Skills, and Experience of the Board as a Whole

| | |  | | CEO or senior executive leadership experience

| | | | | | | |  | | Diversity of race, ethnicity, gender, age, cultural background, or professional experience

| | | | | | | |  | | Electric utility or nuclear operations experience

| | | | | | | |  | | Engineering, innovation, or technology experience

| | | | | | | |  | | Federal, state, or local government or regulatory experience

| | | | | | | |  | | Financial, banking, or investment experience

| | | | | | | |  | | Knowledge of the traditional operating companies

| | | | | | | |  | | Risk oversight or risk management experience

| | | | | | | | | | | | |

investor.southerncompany.com

| | Item 2 | | | | | | | | | | | | | | APPROVE A BY-LAW AMENDMENT TO PERMIT PROXY ACCESS | | | | | | | • | The Board believes that the implementation of proxy access in the manner set forth in this proposal will provide meaningful rights to our stockholders while promoting responsible use of these rights by stockholders. | | | | | | | • | We have proposed a By-Law amendment to provide that any stockholder or group of up to 20 stockholders who has maintained continuous qualifying ownership of at least 3% of our outstanding shares for at least three years could include a specified number of Director nominees equal to the greater of 2 nominees or 20% (rounded down) of the number of Directors in our proxy materials for our annual meeting of stockholders. | | | | | | | • | The proposal is the result of the Board’s ongoing review of our corporate governance policies, including consideration of a stockholder proposal on this topic that did not pass at the 2015 annual meeting and a similar proposal that was withdrawn after the proponent reviewed the terms of this proposal, recent corporate governance trends, and our ongoing discussions with our large institutional stockholders. | | | | | | | • | This proposal demonstrates the Board’s continuing commitment to strong corporate governance policies and practices that the Board believes are consistent with its goal of creating long-term, sustainable value for our stockholders. | | | | | |  | The Board

recommends a vote

FORapproval of a By-Law amendment to permit proxy access. | this proposal See page 106 ► | | ► | | | |  Seepage 34 for further information. | | | | |

| | Item 3 | | | | | | | | | | | | | | APPROVE AN AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO REDUCE THE SUPERMAJORITY VOTE REQUIREMENTS TO A MAJORITY VOTE | | | | | | | • | Supermajoritysupermajority vote requirementsrequirement like the onesone contained in Article Eleventh of the Restated Certificate of Incorporation as amended (Certificate of Incorporation or Certificate), historically havehas been intended to facilitate corporate governance stability and provide protection against self-interested action by large stockholders by requiring broad stockholder consensus to make certain fundamental changes. | | | | | | | •► | As corporate governance standards have evolved, many stockholders and commentators now view thea supermajority requirementsrequirement as limiting the Board’s accountability to stockholders and the ability of stockholders to effectively participate in corporate governance. | | | | | |  | The Board recommends a voteFORapproval of an amendment to the Certificate to reduce the supermajority vote requirements to a majority vote. | | | | | |  Seepage 36 for further information. | | | | |

Table of Contents 13 Southern Company2016 Proxy Statement

| | Item 4 | | | | | | | | | | | | | | APPROVE AN AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO ELIMINATE THE “FAIR PRICE” ANTI-TAKEOVER PROVISION | | | | | | | • | The “fair price” provision was designed to deter an acquiring party from using two-tier pricing and similar inequitable tactics in an attempt to take over the Company and help assure fair treatment of all stockholders in the event of a takeover attempt. The fair price provision was not designed to prevent a takeover but instead to encourage a potential acquirer to negotiate with the Board to ensure all stockholders receive adequate consideration for their shares. | | | | | | | • | Section 203 of the Delaware General Corporation Law provides similar protections against the type of transactions the fair price provision was designed to defend against, and the Board believes that a separate fair price provision in the Certificate is unnecessary. | | | | | | | • | Eliminating supermajority voting provisions is considered by many commentators and stockholders to be a best practice in corporate governance. | | | | | |  | The Board recommends a voteFORapproval of an amendment to the Certificate to eliminate the “fair price” anti-takeover provision. | | | | | |  Seepage 37 for further information. | | | | |

| | Item 5 | | | | | | | | | | | | | | APPROVE A BY-LAW AMENDMENT TO PERMIT THE BOARD TO MAKE CERTAIN FUTURE AMENDMENTS TO THE BY-LAWS WITHOUT STOCKHOLDER RATIFICATION | | | | | | | • | Our By-Laws currently require that any amendment adopted by the Board be subject to subsequent stockholder ratification. This requirement is not in line with current practices at other publicly-traded companies and presents a number of challenges. Requiring stockholders to ratify all By-Law amendments approved by the Board is burdensome, unnecessary, and an inefficient use of Company resources. | | | | | | | • | The Board believes that the proposed By-Law amendment includes appropriate limits that will continue to protect stockholder rights. | | | | | | | | • The Board is not permitted to alter, amend, or repeal the 10% threshold required to call a special meeting of the stockholders, quorum requirements, indemnification of Directors, or the By-Law amendment procedures. | | | | •The Board will not have the power to alter, amend, or repeal any By-Law adopted by the stockholders which by its terms may be altered, amended, or repealed only by the stockholders. | | | | | | | • | The proposed changes to the By-Laws will give the Board the flexibility needed to make administrative changes and be responsive to corporate governance best practices while continuing to protect stockholder rights. | | | | | |  | The Board recommends a voteFORapproval of a By-Law amendment to permit the Board to make certain future amendments to the By-Laws without stockholder ratification. | | | | | |  Seepage 39 for further information. | | | | |

investor.southerncompany.com

COMPENSATION HIGHLIGHTS

Linking Pay and Performance

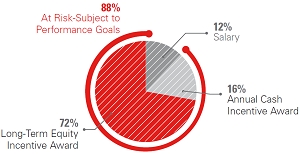

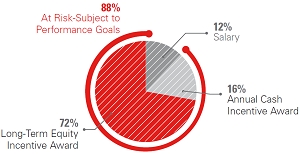

We target the total direct compensation for our executives at market median and place a significant portion of that target compensation “at risk” – subject to achieving both short-term and long-term performance goals. Only the base salary portion of executive compensation is fixed.

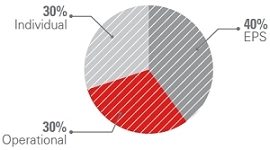

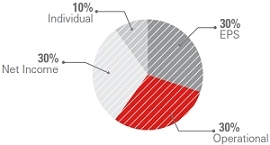

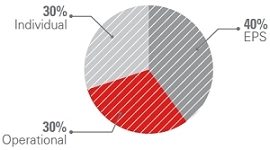

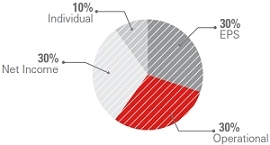

Chief Executive Officer(1) | Other Named Executive Officers(1) | | |  |  | | |

(1) | Annual cash incentive award reflects the target value for 2015 under our Performance Pay Program based on achievement of performance goals. Long-term equity incentive award reflects the target value of the performance shares granted in 2015 under our Performance Share Program. |

Changes for 2015

In early 2015, we made some changes to our compensation program that followed from our focus on continuously refining our executive compensation program to more effectively align executive pay with performance and reflect best compensation practices.

The changes were also consistent with what we heard from investors as part of our ongoing stockholder outreach efforts.

| • | For our long-term equity incentive program, we moved away from granting stock options, which had comprised 40% of the target value of the long-term program in previous years. As of 2015, 100% of the long-term equity incentive program is granted in the form of performance shares that are earned based solely on achievement of pre-established performance goals over a three-year performance period. | | | | | • | We also expanded the performance goals for the performance shares to include a cumulative three-year earnings per share (EPS) goal (25% weighting) and an equity-weighted return on equity (ROE) goal (25% weighting), while retaining a relative total shareholder return (TSR) performance goal (50% weighting). | | | | | • | For our annual cash incentive program, we added individual performance goals for executive officers to drive individual performance that we believe will lead to long-term success for the Company. |

Performance Results

| • | 2015 was an outstanding year for us, as we continued the strong performance by our franchise operations. We had strong financial performance from our wholesale subsidiary, Southern Power Company, and our traditional operating companies, with our reported adjusted* EPS results just above our EPS guidance range for the year. | | | | | • | We also demonstrated strong operational performance for the year across the Company. Operational measures included customer satisfaction, safety, major projects, culture, reliability, availability, and nuclear plant operations. | | | | | • | We have created long-term value for our stockholders, reflected in our outperformance against the S&P 500 and the Philadelphia Utilities Index over the last 10-year, 20-year, and 30-year periods (seepage 46). While our stock price has not performed as well over the past few years as it has over the long term, we did increase our dividend again in 2015 for the 14thconsecutive year. | | | |

* | For a description of how we calculate adjusted financial measures, seepage 105. |

Southern Company2016 Proxy Statement

Annual Cash Incentive Plan – 2015 Performance Pay Program

Our Performance Pay Program rewards annual financial and operational performance as well as individual named executive officer (NEO) performance. We had strong financial and operational performance for 2015, exceeding our overall targets for the year. The Compensation and Management Succession Committee

(Compensation Committee) also believed the 2015 individual performance contributions by our NEOs were strong. Accordingly, payouts for all participants in the program, including the NEOs, were above target. For the NEOs, payouts ranged from 141% to 160% of target.

Long-Term Equity Incentive Plan – 2013-2015 Performance Share Program

In 2013, 60% of the target value of our long-term equity incentive plan was granted in the form of performance shares under our Performance Share Program. For the three-year performance period of 2013 through 2015, performance shares could be earned based on a relative

TSR performance goal. Our three-year TSR performance relative to the peer groups selected by the Compensation Committee was below target. All participants in the program, including the NEOs, earned performance share awards at 28% of target.

| | Item 6 | | | | | | | | | | | | | | ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION (SAY ON PAY) | | | | | | | • | We believe our compensation program provides the appropriate mix of fixed and short- and long-term performance-based compensation that ties pay to Company performance, rewards achievement of financial and operational goals and relative TSR, and is aligned with stockholder interests. | | | | | |  | The Board recommends a voteFORapproval of executive compensation. | | | | | |  Seepage 77 for further information. | | | | |

| | Item 7 | | | | | | | | | | | | | | APPROVE THE MATERIAL TERMS FOR QUALIFIED PERFORMANCE-BASED COMPENSATION UNDER THE OMNIBUS PLAN | | | | | | | • | The 2011 Southern Company Omnibus Incentive Compensation Plan (Omnibus Plan) was previously approved by stockholders at the 2011 annual meeting. | | | | | | | • | Approval of the material terms for performance-based compensation under the Omnibus Plan is being sought to satisfy certain requirements under Section 162(m) of the Internal Revenue Code of 1986, as amended (the tax code), to preserve our ability to deduct, for federal income tax purposes, certain performance-based awards granted under the Omnibus Plan to particular executive officers. | | | | | | | • | Stockholders are not being asked to approve additional shares under the Omnibus Plan or approve any changes to the material terms of the performance goals or any other terms of the Omnibus Plan. | | | | | |  | The Board recommends a voteFORapproval of the material terms of the qualified performance-based compensation under the Omnibus Plan. | | | | | |  Seepage 78 for further information. | | | | |

investor.southerncompany.com

| | Item 8 | | | | | | | | | | | | | | RATIFY THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2016 | | | | | | | • | The Audit Committee has appointed Deloitte & Touche LLP (Deloitte & Touche) as our independent registered public accounting firm for 2016. | | | | | | | • | This appointment is being submitted to stockholders for ratification. | | | | | |  | The Board recommends a voteFORratification of the appointment of Deloitte & Touche as our independent registered public accounting firm for 2016. | | | | | |  Seepage 83 for further information. | | | | |

Stockholder Proposals

| | Items 9-10 | | | | | | | | | | | | | | VOTE ON TWO STOCKHOLDER PROPOSALS | | | | | | | • | We have been advised that two stockholder proposals are intended to be submitted at the annual meeting. | | | | | |  | The Board recommends a voteAGAINSTeach of the stockholder proposals. | | | | | |  Seepage 88 for further information. | | | | |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Please review “Frequently Asked Questions About Voting and the Annual Meeting” onpage 92.

Southern Company2016 Proxy Statement

Table of Contents

See the Definitions of Key Terms on page 119 that defines many key terms and acronyms used in this proxy statement. | New or notable in this proxy statement | | | | ► | Environmental and social highlights that are of interest to our investors and other stakeholders | | 5 | | ► | Board oversight of key ESG risks | | 5 | | ► | Extensive stakeholder engagement efforts that include independent Director participation and how we have responded to feedback | | 27, 53 | | ► | Describe “Rooney Rule” language in Corporate Governance Guidelines confirming the Board’s commitment to actively seek out diverse candidates | | 33 | | ► | Cybersecurity governance and risk oversight | | 40 | | ► | Operational goals for annual incentive award promote our sustainable business model and align with key ESG matters | | 58 | | ► | GHG reduction goal is part of the CEO’s long-term equity incentive compensation program | | 65 | | ► | Enhanced Clawback Policy that applies to senior management | | 70 |

Table of Contents Southern Company 2021 Proxy Statement 14

Table of Contents Southern Company Board of Director Nominees 15

Table of Contents Southern Company 2021 Proxy Statement

16 Board of Director Nominees Qualifications, Attributes, Skills and Experience We believe effective oversight comes from a Board that represents a diverse range of experience and perspectives that provides the collective qualifications, attributes, skills and experience necessary for sound governance. The Nominating, Governance and Corporate Responsibility Committee establishes and regularly reviews with the Board the qualifications, attributes, skills and experience that it believes are desirable to be represented on the Board to help ensure that they align with the Company’s long-term strategy. The most important of these are described below. We believe our Directors possess a range and depth of expertise and experience to effectively oversee the Company’s operations, risks and long-term strategy.  | Stock Ownership of DirectorsPUBLIC COMPANY CEO EXPERIENCE

Experience serving as a public company CEO with strong business acumen and Executive Officersjudgment.

| 865/13  |  | Stock OwnershipAUDIT COMMITTEE FINANCIAL EXPERT

Experience as a principal financial officer, principal accounting officer, controller, public accountant or auditor of 5% Beneficial Ownersa public company or experience actively supervising such person or persons. Experience preparing, auditing, analyzing or evaluating public company financial statements and an understanding of a company’s internal controls and procedures for financial reporting.

| 875/13  |  | GEOGRAPHIC REGIONAL

Understanding and experience working in the business and political environment of the Company’s residential, commercial and industrial customer base. | 7/13  |  | NATIONAL SECURITY CLEARANCE

Holding active national security clearances such that one can provide effective oversight on key securities issues for the Company as an important component of U.S. critical infrastructure. | 4/13  |  | SOUTHERN OPERATING COMPANY BOARD EXPERIENCE

Experience serving on the board of directors of one of the Company’s operating companies. | 4/13  |  | BUSINESS INTEGRATION

Demonstrated leadership and operational experience with the integration and disposition of business divisions. | 8/13  |  | CYBERSECURITY

Experience and contemporary understanding of asymmetrical cyber threats (both to private and governmental actors), risk mitigation and policy gained through operational experience. | 5/13  |  | ENVIRONMENTAL

Exposure and understanding of oversight of environmental policy, regulation, risk and business operation matters in highly regulated industries. Experience reducing environmental risks to provide safe, reliable and responsible business operations. An in-depth understanding of the risks and opportunities for an organization in a low-carbon future. | 5/13  |  | FINANCE/BANKING

Exposure to deal-making (including in M&A), financial plans and programs and capital allocation experience, and familiarity with Wall Street and/or other major financial institutions. | 8/13  |  | GOVERNMENT AFFAIRS AND REGULATORY

Exposure to heavily regulated industries, having worked in public policy for a significant institution or leading a corporate function (e.g., government affairs) that influences the public policy and regulatory process, or a senior executive with experience directly managing one or more members of management engaged in such activities. | 9/13  |  | MAJOR PROJECTS

Experience overseeing, managing or advising on large scale capital projects in the industrial sector. Knowledge of creating long-term value through the financing of and capital allocation for the construction of large-scale capital projects. | 7/13  |

Table of Contents Item 1: Election of 13 Directors

17  | Section 16(a) Beneficial Ownership Reporting ComplianceNUCLEAR

Deep knowledge and experience in the construction, operations and regulation of nuclear energy.

| 874/13  |  | TECHNOLOGY (DIGITAL)

Demonstrated experience leading digital technology strategy, navigating associated disruption of legacy businesses and/or expertise in social media strategy, including knowledge of data analytics and associated IT infrastructure investments to support digital transformation. | 4/13  |  | TECHNOLOGY (TECHNICAL)